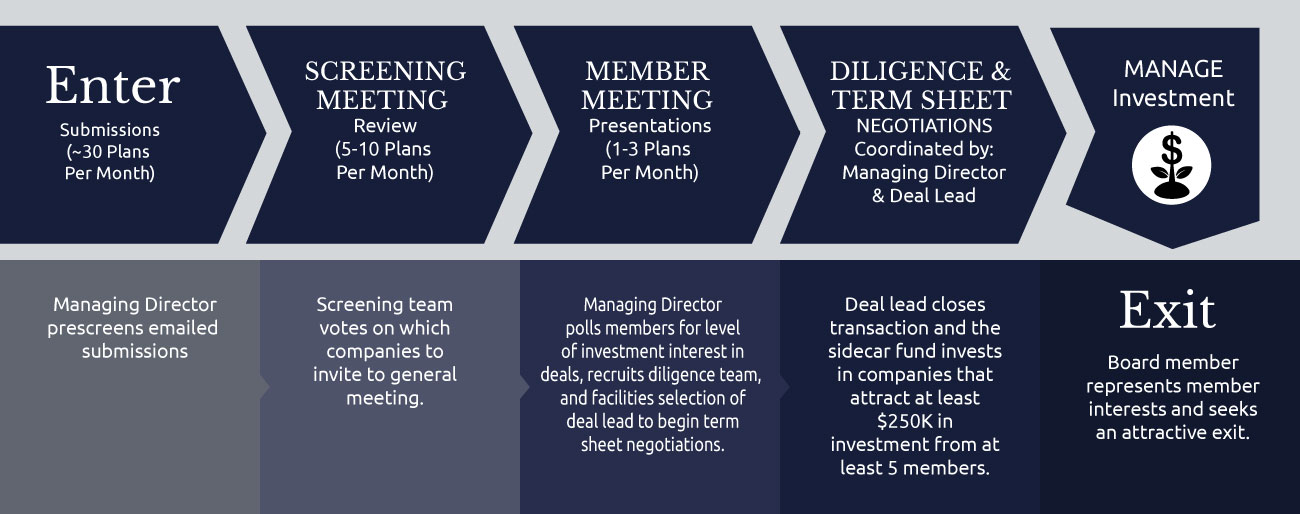

The Investment Process

We have detailed processes in place to identify high-potential investment opportunities. We receive over 300 applications annually. Only the top 20 are presented to members and we have historically invested in 5-10 per year.

As a member-sponsored organization, the key aspects of our deal evaluation and investment processes are managed by member-run committees:

- Deal Flow Committee

- Screening Committee

- Due Diligence Committee

- Growth and Transaction Committee

- Additionally, members can increase their involvement by taking on board positions in portfolio companies and deal negotiation roles. This structure allows members to be as active, or passive, in the evaluation and management process as they desire.

Application

- The process begins with the entrepreneur applying via Gust, our online deal management system.

- The Deal Flow Committee reviews applications and reviews promising companies to present before the Screening Committee.

Screening

- Approved companies pitch to the Screening Committee – a subset of our membership and technical advisors – at a monthly Screening Meeting.

- Following a 20-minute presentation and 15-minute Q&A, the committee may approve the company to proceed to due diligence.

Member Meeting

All members are invited to attend the monthly Member Meetings where only the most promising opportunities are presented.

- Entrepreneurs get 20 minutes to pitch their investment opportunity, 15 minutes to answer questions, and the membership votes to express their level of interest in the opportunity.

Due Diligence

- If an opportunity garners enough membership interest, the deal moves to investment.

- The Due Diligence Committee follows NVCA best practices and will spend several weeks meeting with the management team and vetting the opportunity with a detailed due diligence checklist and plan.

Negotiation and Closing

- Throughout the process, assuming the DD results are favorable, we will negotiate the term sheet.

- If a mutually agreeable term sheet is negotiated, we will complete our process and close the deal.

Management

- The deal management process is hands-off for most investors.

- For each portfolio company, a monitor or a board director is assigned to be the lead contact for our investment group. The monitor or director is assigned with tracking the progress of the company and providing assistance, as necessary.

- The Growth and Transaction Committee meets to discuss the status of each portfolio company, and collaborates with portfolio companies to help them reach their full potential.